ESG Finance

INDEX

- Donation to Saitama University, Shika Town in Ishikawa Prefecture, and Noto Town.

- Donated electric vehicles (EVs) and educational support materials to Niiza City Certificate of Appreciation from the Mayor of Niiza City

- Green Bond

- Notice of Conclusion of a Sustainability Linked Loan Agreement

Donation to Saitama University, Shika Town in Ishikawa Prefecture, and Noto Town.

July 4, 2024

Sanken Electric Co., Ltd. (hereinafter referred to as "the Company") continued its collaboration with Saitama Resona Bank by utilizing the "Saitama Resona CSR Private Bonds with Donated Items" for the second consecutive year. The collaboration facilitated donations from Saitama Resona Bank to Saitama University, including audiovisual equipment such as projectors, cameras, and online devices. Additionally, contributions were made to Shika Town and Noto Town in Ishikawa Prefecture, including monitors, projectors, and tents for use in all elementary and junior high schools, as well as for sports day events.

The "Donation-Included CSR Private Bonds" is a program where we utilize a portion of the fees generated from issuing bonds to specify the donation recipients and items, which are then donated to us by the bank.

A presentation ceremony was held at Saitama University on Thursday, July 4th, and President Sakai expressed words of gratitude.

The donations to Shika Town and Noto Town were made in appreciation for the various support received from the local communities and neighboring individuals following the Noto Peninsula earthquake that occurred on New Year's Day in 2024, which affected our group company, Ishikawa Sanken. Thanks to the assistance from the municipalities and the local community, we were able to resume production in March. The donations this time are a token of our gratitude.

Our company will continue to engage in activities rooted in the local community as part of our corporate value creation, aiming to contribute to various stakeholders. We will persistently pursue endeavors that make a positive impact on society, ensuring that we can contribute in a meaningful way to the communities and stakeholders we serve.

Donated electric vehicles (EVs) and educational support materials to Niiza City Certificate of Appreciation from the Mayor of Niiza City

April 20, 2023

Sanken Electric Co., Ltd. recently cooperated in Saitama Resona Bank's donation of electric vehicles (EVs) to Niiza City and educational support materials to elementary and junior high schools in the city through "Saitama Resona CSR Private Placement Bonds with Donated Goods" handled by Saitama Resona Bank. The "CSR Private Placement Bonds with Donated Goods" is a bond issue in which we use a portion of our fees from the issuance of the bonds to designate the recipients and items to be donated to the bank.

On April 20 (Thu), a presentation ceremony was held at Niiza City Hall. After opening remarks by Mr. Satoshi Fukuoka, President and CEO of Saitama Resona Bank, and Mr. Masaru Takahashi, President of our company, Mr. Fukuoka presented the donation catalogue to Mr. Suguru Namiki, Mayor of Niiza City, and Mr. Namiki, Mayor of Niiza City, and Mr. Kaneko, Chief Education Officer, presented a certificate of appreciation to the donors.

We have been doing business in Niiza for 71 years, and have grown along with the development of the city of Niiza. We will continue to contribute to society in various ways so that we can grow as a company that is valuable to the local community and to our various stakeholders.

Green Bond

Green Bond Issuance

Sanken Electric Co., Ltd (hereinafter referred to as "the Company") issued Green Bonds in June 2022.

Sanken Electric promotes ESG management and aims to contribute to a sustainable society through its core business of power semiconductors. With regard to GHG emissions, which are feared to have an impact on climate change, the Company is monitoring emissions throughout its supply chain in Scope 1, 2, and 3. We aim to reduce GHG emissions in Scope 1 and 2 by 33% from the fiscal 2020 level by 2030, and beyond that, we will accelerate our efforts to achieve our long-term goal of carbon neutrality by 2050.

We will contribute to the resolution of social issues by investing the proceeds of this Green Bond issue in projects that will reduce GHG emissions.

Green Finance・Framework

We have established a Green Finance Framework to ensure that the funds raised through Green Bonds are used appropriately.

This framework is based on the "Green Bond Principles 2021" of the International Capital Markets Association (ICMA),the "Green Bond Guidelines 2020" of the Ministry of the Environment, the "Green Principles 2021" of the Loan Market Association (LMA),the Asia-Pacific Loan Market Association (APLMA), and the Loan Syndication and Trading Association (LSTA),and the "Green Principles 2021" of the International Finance Association (IFA).The Green Bond Guidelines are based on the Green Principles 2021 of the Loan Syndication and Trading Association (LSTA) and the Sustainability Linked Loan Guidelines 2020, and are third-party certified by R&I.

| Name | 14th Series of Unsecured Bonds of Sanken Electric Co., Ltd. (With limited inter-bond pari passu rider) (Green Bond) |

|---|---|

| Condition determination date | June 10, 2022 |

| Date of issue | June 16, 2022 |

| Maturity of issue | 5 years |

| Total issuance | 5 billion yen |

| Use of proceeds | Capital investment and research and development related to semiconductor products for electric vehicles (EVs) |

| Framework | Green Finance・Framework |

| Second-party opinion | R&I Second Opinion. |

| Reporting | SANKEN ELECTRIC CO., LTD. 14th Unsecured Bond (Green Bond) Reporting(FY2022) |

| SANKEN ELECTRIC CO., LTD. 14th Unsecured Bond (Green Bond) Reporting(FY2023) | |

| SANKEN ELECTRIC CO., LTD. 14th Unsecured Bond (Green Bond) Reporting(FY2024) | |

| Press release | Notice of Green Bond Issue. |

| Notice on terms and conditions of Green Bond issuance. |

Notice of Conclusion of a Sustainability Linked Loan Agreement

September 27, 2021

Sanken Electric Co., Ltd. (headquartered in Niiza City, Saitama Prefecture, hereinafter "we") entered into a syndicated Sustainability Linked Loan ("SLL") agreement with Resona Bank, Ltd., Saitama Resona Bank, Ltd., Mizuho Bank, Ltd., the Mitsubishi UFJ Bank, Ltd., Sumitomo Mitsui Banking Corporation, and the 82 Bank, Ltd. on this date. We hereby provide the following information.

The SLL is based on the SLL Principles established by the Loan Market Association ("LMA") and other bodies, and the Company has established an ambitious Sustainability Performance Target ("SPT"). By linking its achievement with interest rates and other borrowing conditions, the SLL aims to enhance the Company's commitment to sustainable management and, through its achievement, to grow and promote economic activities that are sustainable in terms of the environment and society.

We have identified two material issues as materiality: initiatives to save electricity and increase efficiency through the development, production, and sale of eco-energy-efficient products; and efforts to reduce environmental impact in implementing our core business. We are committed to contributing to the realization of a sustainable society through the development, production, and sale of power electronics products that use high reliability and cutting-edge technologies. As part of these efforts, in light of the strong social demands for preventing global warming, the SLL Agreement we signed this time stipulated in the SPT the rate of reduction in CO2 emissions (Scope 1 and 2*) compared to fiscal 2020 as an effective milestone for achieving reductions in environmental impact over the medium to long term.

Through this financing, we will develop measures to reduce CO2 emissions of electricity required for production, in conjunction with the further promotion of our core business of developing environmentally conscious products globally. As a specific measure, we plan to achieve zero CO2 emissions and "carbon offset" at the Horimatsu Plant through initiatives for the utilization of renewable energy, including not only energy conservation at the Ishikawa Sanken-Horimatsu Plant, our group company, but also the development of on-site forests, the installation of solar power plants, and clean energy derived from hydroelectric power. We also plan to accelerate efforts to reduce CO2 at each Group company.

Summary of the SLL Agreement

| Contract day | September 27, 2021 |

|---|---|

| Term | 3 years |

| Amount of borrowing | 10 billion yen |

| Use of funds | Long-term business fund |

| Lender | Resona Bank (Arranger), Saitama Resona Bank (Co-Arranger) Mizuho Bank, Mitsubishi UFJ Bank, Sumitomo Mitsui Banking Corporation, 802 Bank |

| KPI | CO2 emission reduction rate |

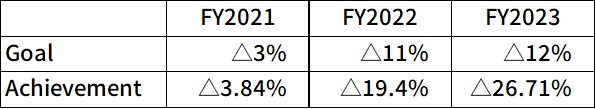

| SPT | The CO2 emission reduction rate per fiscal year (in total amount, Scope 1, 2※) for our company and domestic consolidated subsidiaries is set at 3% for FY2021, 11% for FY2022, and 12% for FY2023, achieving a cumulative 12% reduction compared to FY2020. All the set SPTs for each year have been achieved and the results have been independently assessed by the Japan Credit Rating Agency. <SPT Achievement Status>

|

- * Scope 1: Direct emissions of greenhouse gases by businesses themselves

- * Scope 2: Indirect emissions associated with the use of electricity, heat, and steam supplied by other companies

This SLL Agreement has been granted by the Japan Credit Rating Agency, Ltd. ("JCR") a third-party opinion on the SLL principles established by the LMA, etc., as well as the conformity to the Green Loan and Sustainability Link Loan Guidelines issued by the Ministry of the Environment, and the reasonableness of the established SPT.

For details, please refer to the release published by JCR.

https://www.jcr.co.jp/greenfinance/sustainability/topic/