Compliance

INDEX

- Internal Control Committee

- Internal Audit

- Internal Reporting System (Helpline System)

- Compliance Education

- Tax transparency

- Anti-Corruption

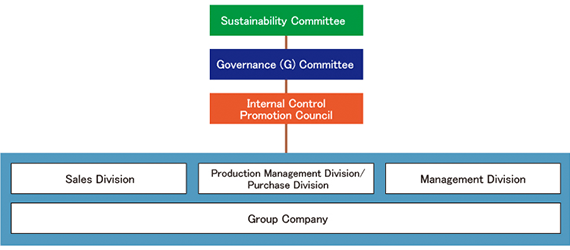

Internal Control Committee

In order to maintain and promote a system to ensure the reliability of financial reporting as stipulated by the Financial Instruments and Exchange Act, we have established the Internal Control Promotion Committee, chaired by the General Manager of the Internal Audit Office, to support the inspection of operations in each division of us and Group companies and to examine and evaluate the effectiveness of control activities at the company-wide level and at the business process level. We are continuously working to review control items in business processes and improve the efficiency of evaluation operations.

Internal Audit

Based on the Conduct Guidelines (Standards of Conduct), we conduct internal audits and monitoring with the aim of complying with ethical laws and regulations, risk management, deterring and discovering improprieties, and improving management efficiency. In terms of auditing methods, we focus on auditing selected themes based on an assessment of importance and degree of impact based on the risk approach. Domestic and overseas Group companies are also subject to audits, and by conducting audits of a content that meets the needs of management, we aim to realize the added value of internal audits (proposals for improvement) and support and promote management risk management.

The results of internal audits are reported to the Representative Director, the Board of Directors and the Audit and Supervisory Committee, and are reflected in the business operations and systems of the Company and Group companies and in the correction and improvement of these management methods. In addition, through monitoring that regularly analyzes the data accumulated in the mission-critical system, business activities are observed, and in the event that abnormal values are discovered, feedback is provided to on-site divisions to encourage improvement.

Internal Reporting System (Helpline System)

Sanken Electric and the Sanken Group in Japan have established an internal reporting system to detect and rectify internal improprieties, illegal activities, violations of internal regulations, harassment, etc. at an early stage.

This internal reporting system assumes the use of the system when reporting and consultation are difficult through the corporate system.

The whistle-blowing hotline for the internal reporting system is entrusted to an external third-party organization to ensure anonymity and is notified to the Internal Audit Office "anonymously."

The Internal Audit Office investigates the details of reports and takes corrective action to resolve any problems that have been identified.

In addition, the whistle-blowing system prohibits whistleblowers and investigators from dealing with any disadvantages. In this way, the system is operated in consideration of the protection of whistleblowers and investigators.

Compliance Education

We are working to foster and disseminate compliance awareness among our and Group company employees by conducting e-learning and compliance education using booklets, and by publishing compliance news based on familiar examples.

Tax transparency

1. Basic Policy

The Sanken Group will comply with applicable tax-related laws and regulations in each country where it is located and will respect the spirit of such rules, laws and regulations, etc. In addition, the NTA complies with the international tax guidelines and recommendations presented by OECD, etc., and fulfills its social responsibilities by paying taxes in a timely and appropriate manner through them.

2. Tax Risk Management

The tax function will endeavor to minimize financial risk by closely cooperating with the business operation division and sharing information. In Sanken Group intercompany transactions, we analyze the functions, risks and the existence of significant intangibles of foreign group companies and set transaction prices in accordance with OECD Transfer Pricing Guidelines and our Transfer Pricing Policy.

3. Tax planning

The Sanken Group aims to maximize corporate value while complying with applicable tax-related laws and regulations. If there are multiple options for tax treatment to the extent consistent with business and legislative objectives, select the most advantageous method. We will not use tax avoidance schemes that do not intentionally match the actual state of the business or use tax havens for tax avoidance purposes.

4. Relationship with Tax Authorities

The Sanken Group will strive to maintain good relations with tax authorities in each country and region in earnest. Regarding matters pointed out by tax authorities, the Group will take preventive measures in accordance with applicable tax-related laws and regulations. In the event of a discrepancy of views, we will respond professionally and in good faith and engage in constructive dialogue toward resolution in accordance with applicable tax-related laws and regulations, etc.

5. Personnel Structure

Personnel in charge of tax affairs are assigned to the Finance Control Department, and complex matters are dealt with in cooperation with outside experts as appropriate.

Anti-Corruption

Regarding this matter, it is established in the "Sanken Group CSR Basic Policy." The regulations are specified in the Conduct Guidelines and Employment Regulations, and are well-known to all employees. We have also disseminated this information to our business partners through the "Sanken Group Supply Chain CSR Promotion Guidebook."